How Estate Planning Attorney can Save You Time, Stress, and Money.

Examine This Report about Estate Planning Attorney

Table of ContentsEstate Planning Attorney Can Be Fun For EveryoneNot known Incorrect Statements About Estate Planning Attorney Facts About Estate Planning Attorney UncoveredSome Known Details About Estate Planning Attorney

If you get long-lasting treatment or other services with Medicaid, the Medicaid Recuperation program might seek payment by declaring several of your estate, like your home, after you pass away. A strong estate strategy will certainly shield your properties and enable you to pass on as much of your estate as possible.It seems tiresome however it's crucial to speak with all your possibility lawyers, since estate planning is a personal process. Will you send me updates on my estate plan in the future or is this a single service? If you're functioning with an estate legal representative from a huge law firm, it's important to know if you will certainly function exclusively with one person.

Get This Report about Estate Planning Attorney

Attempt to talk with individuals that have actually collaborated with the attorney, like their customers or perhaps one more attorney. Lawyers that are challenging to deal with or that deal with people improperly will likely develop such a track record promptly with their peers. If required, have a follow-up conversation with your prospective estate attorney.

When it concerns ensuring your estate is intended and managed appropriately, hiring the ideal estate planning attorney is necessary. It can be hazardous to make such a huge decision, and it is very important to know what questions to ask when taking into consideration a law practice to manage your estate intending project.

You'll inquire regarding the tools offered for thorough estate strategies that can be tailored to your distinct scenario. Their qualifications for practicing estate planning, their experience with special research study tasks associated to your specific job, and just how they structure their settlement models, so you have correct assumptions from the start.

Excitement About Estate Planning Attorney

It is important to note that estate planning files are not simply for rich people; everyone should take into consideration having at least a standard estate strategy in position. With this being said, it's necessary to recognize what duties an estate preparation lawyer has to ensure that you can find one that meets your distinct needs and objectives.

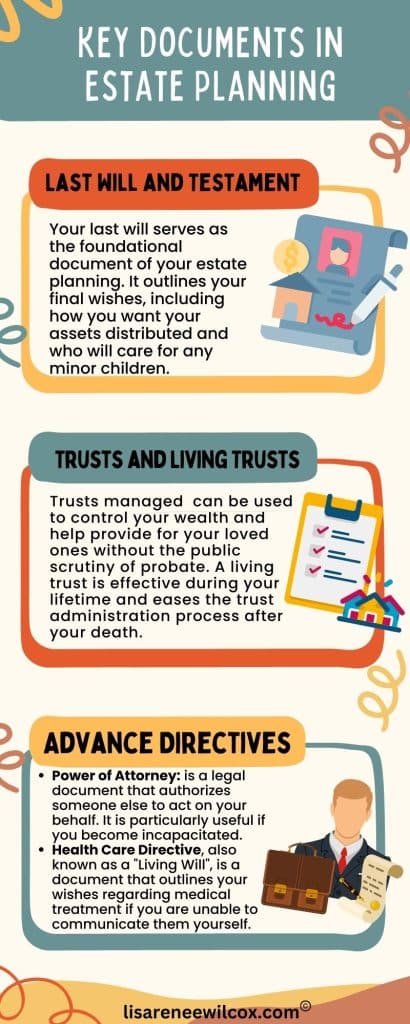

This includes helping the client determine their assets and responsibilities and their dreams concerning the distribution of those possessions find out here now upon death or incapacitation. The estate preparation attorney will examine any kind of present files that the customer might have in location, such as wills, depends on, and powers of lawyer, to ensure they are current with state legislations.

On top of that, the estate preparation lawyer will certainly work with the customer to evaluate their tax obligation scenario and recommend strategies for decreasing tax obligations while additionally attaining the wanted objectives of the estate plan. An estate planning attorney need to be spoken with whenever there are any kind of adjustments to a person's economic situation or family members structure, such as marital relationship or divorce - Estate Planning Attorney.

With all these obligations in mind, it is essential to understand what credentials one ought to look for when picking an estate organizer. When picking an estate preparation lawyer, it is very important to ensure that they are qualified and experienced. Many estate preparation lawyers have years of specialized training in the field and experience collaborating with customers on their estate strategies.

The Main Principles Of Estate Planning Attorney

Experience and knowledge are crucial when choosing an estate planning attorney, but there are other considerations. For instance, some attorneys might focus on specific areas, such as elder regulation or business sequence preparation, while others might be more generalists. It is also important to consider the references given by the lawyer and any type of evaluations they have received from previous customers.

This will permit you to recognize their character and experience level and ask inquiries regarding their practice and strategy to estate preparation. By asking these concerns go to this web-site ahead of time, you will better recognize exactly how each attorney would certainly handle your scenario before devoting to collaborate with them on your estate plan. You have to ask the best inquiries when choosing an estate planning lawyer to guarantee that they are the most effective suitable for your needs.

When choosing an estate planning lawyer, it is essential to recognize what types of solutions they use. Ask about the lawyer's specific estate preparation solutions and if they can develop a tailored estate plan customized Home Page to your needs. Likewise, ask if they have experience developing living trust papers and other estate planning tools such as powers of attorney or healthcare instructions.